Gross rental income is an essential calculation for CRE professionals who want to maximize their investment returns, helping them make financial forecasts, budgets, and critical investment decisions.

Post-pandemic, the commercial real estate (CRE) industry is faring better compared to the five years prior.

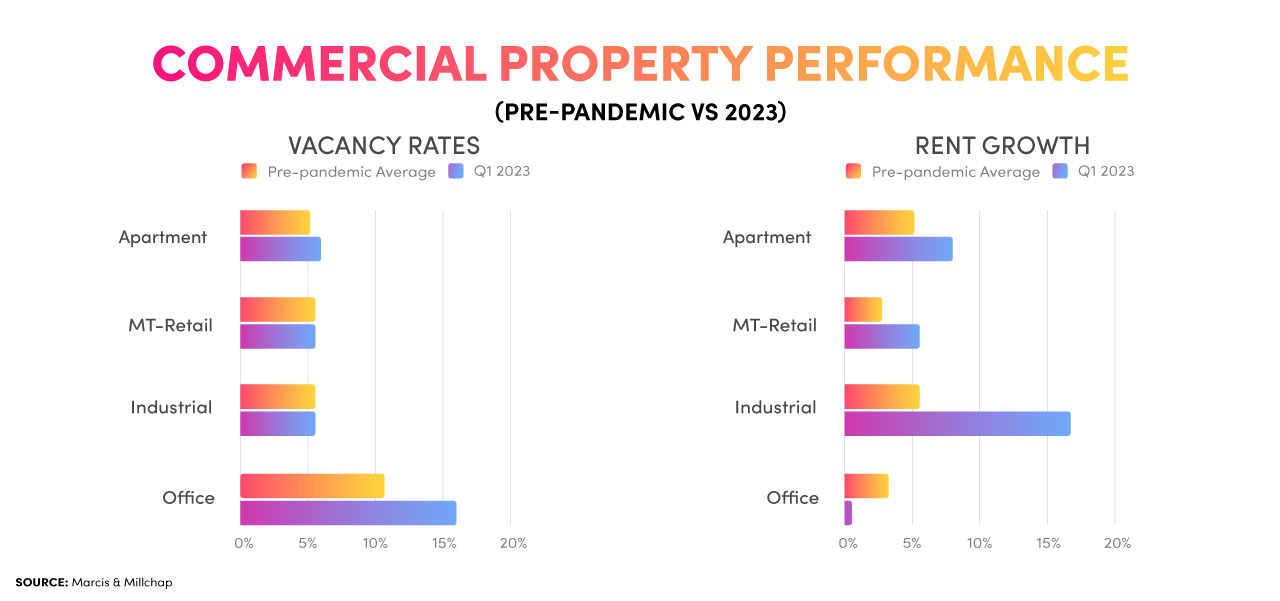

Research by Marcus & Millichap on pre-pandemic versus post-pandemic vacancies and gross rent growth shows that office space had the greatest vacancy rates and the slowest rise in gross rental income in Q1 of 2023.

Due in part to remote and hybrid work, industrial real estate witnessed the fastest rent growth and the lowest vacancy rates.

Why does this matter? Because understanding which areas of the CRE market are performing best will affect your achievable rental income. Vacancy rates matter too because they can affect your annual gross rental income.

We’ve put together this guide to help you understand exactly what gross rental income means, and how you can use this calculation in your CRE ventures.

Understanding Gross Rental Income in the Commercial Context

Gross rental income, or GRI, is a key component of calculating a property’s income-generating potential.

By accurately gauging gross rental income for a property, CRE professionals can:

● Estimate profitability potential

● Evaluate the financial health of the property

● Negotiate leases efficiently

● Identify ways to increase revenue while reducing costs

● Optimize ROI by reducing vacancies and operating costs

GRI is used in pre-investment due diligence for various purposes, including evaluating the property’s ability to generate income, informing investment decisions, determining competitive rental rates, measuring the overall market value of a property, and calculating net operating income (NOI).

Gross rental income in CRE differs from residential rental income.

The main difference is that in residential, rental income is often a singular figure relating to the leasing of an individual home or apartment.

In commercial property, you often have more than one sum of money coming in each month, which all need to be totaled up. This is because commercial properties tend to involve multiple tenants and more complicated lease structures, which results in more complex financial assessments.

The Components of Gross Rental Income

Gross rental income refers to the total revenue generated by a property before deducting operating costs. This revenue includes rent and additional fees such as:

● Late payment charges

● Parking fees

● Service charges

Fees can vary depending on the tenant agreement or property management policy.

Gross rental income also includes reimbursements for operating costs. These can include:

● Utility bills

● Maintenance costs

● Insurance

● Taxes

Generally, these operating costs are included in the lease terms in CRE.

Calculating Gross Rental Income

Calculating GRI is a straightforward sum:

Add all rental income received from tenants over a specific period, typically monthly or annually.

Practical Example

For example, an office space generating $5,000 in monthly rent and $500 in parking fees has a total monthly rental income of $5,500. Annually, this amounts to a gross rental income of $66,000 ($5,500 x 12 months).

Gross Scheduled Income vs. Gross Operating Income

Gross scheduled income (GSI) is the total potential income a property could generate if it were fully occupied and leased at market rates, without deductions or expenses.

It includes income from all rentable spaces but doesn't account for vacancies or losses due to unpaid rent. GSI is crucial for financial planning and evaluating a property's earning capacity.

Gross operating income (GOI) represents the actual income generated from a property after taking vacancies and rental losses into account. Note that it does not take expenses into account.

The GOI is usually equivalent to the GRI. It’s just a matter of terminology.

GOI is used to calculate the property's ability to cover operating costs and service debt while giving an accurate picture of its income-generating capabilities. To get the actual cash flow, you should use net operating income (NOI), which also deducts operating expenses.

Impact of Lease Types on Gross Rental Income

Commercial leases in CRE are categorized into gross leases and net leases. Gross rental income therefore depends heavily on the type of lease you have.

Gross Lease

Tenants pay a monthly rental covering all operating expenses. This is simpler for tenants and easier to budget, but property owners have more administrative responsibilities.

Full-service Lease

Similar to a gross lease, but often includes additional services such as janitorial services, extensive repairs, building security, and equipment. Full-service leases typically generate higher gross income.

Net Lease

A net lease is the opposite of a gross lease. Tenants pay a base rent plus a proportionate share of the operating expenses. The main types of net leases are:

● Single Net

● Double Net

● Triple Net

In a single net lease, tenants pay a base rent plus their share of property taxes. The landlord covers other operating expenses like insurance and maintenance.

With a double net (NN) lease, tenants are responsible for base rent, property taxes, and insurance costs. The landlord typically manages maintenance and structural repairs.

In a triple net (NNN) lease, tenants pay the base rent along with property taxes, insurance, and maintenance expenses. This lease transfers almost all operating costs and responsibilities from the landlord to the tenant.

Because triple net leases pass on nearly all expenses, they lead to the lowest gross rental income for landlords. These types of leases are generally long-term (five or 10 years) which means they bring in reliable, steady income.

However, a net lease structure is still a win-win for both parties. Tenants benefit from lower base rent and operating control over the property, while landlords find the net lease structure less administrative.

Importance of Gross Rental Income in Investment Decisions

Gross rental income is pivotal in evaluating the profitability and potential return of CRE ventures.

It directly influences the calculation of net operating income (NOI) and, thus, a property's investment appeal.

It’s important to note, however, that a property with unusually high maintenance costs might have a lower NOI despite having a healthy GRI. This is why it’s essential for CRE owners to keep on top of property maintenance, and other operational costs.

Real-Life Examples of Gross Rental Income Calculation

Here are examples of how to calculate gross rental income in different scenarios:

Commercial Property Lease

Imagine a commercial building housing various businesses with varying lease terms and rents. If there are ten spaces leased out with monthly rents ranging from $2,000 to $5,000, the total gross monthly rental income is obtained by adding all individual rental incomes: ($2,000 + $2,500 + ... + $5,000) = Total gross monthly rental income.

Mixed-Use Property

In cases where a property encompasses both residential and commercial units, the gross rental income involves firstly calculating the total income generated from each unit type separately. You then add them up to arrive at the overall gross rental income.

Common Mistakes to Avoid in Calculating Gross Rental Income

Property owners often make mistakes when calculating gross rental income, for example:

● Failing to keep track of all income streams

● Overlooking vacancies

● Letting tenants fall behind on payments

To prevent these mistakes, it’s important to keep accurate records. Regularly review lease agreements to find hidden or missed income streams.

If you’re using property management software or hiring professional accounting services, you’ll be assured of an even more comprehensive and precise calculation of your gross rental income.

Final Thoughts on the Importance of Gross Rental Income

Gross rental income is one of the first, and most important metrics you’ll come across in any CRE calculation. You’ll use it over and over again to evaluate the profitability and viability of a potential property deals.

It helps to not only spotlight immediate income opportunities but also to strategize for long-term growth and stability.

As always, if you find yourself getting stuck, get help from a professional CRE broker, who can help you work your way through the maze of numbers.

Wishing you success in your CRE journey!

.jpg)