Big decisions are never easy to make. Especially when the stakes are high, the investment is significant, and the competition is fierce. This is particularly the case in the dynamic realm of retail in commercial real estate (CRE). One strategic tool CRE brokers can use to navigate the unique challenges and capitalize on the opportunities within the retail sector, is a SWOT risk analysis.

In this guide, we’ll take you through six steps to perform your own SWOT risk analysis for those all-important retail decisions. We’ll cover how you can harness the power of geographic information systems (GIS) to get access to more in-depth data and analysis. Let’s dig in.

What is a SWOT Risk Analysis?

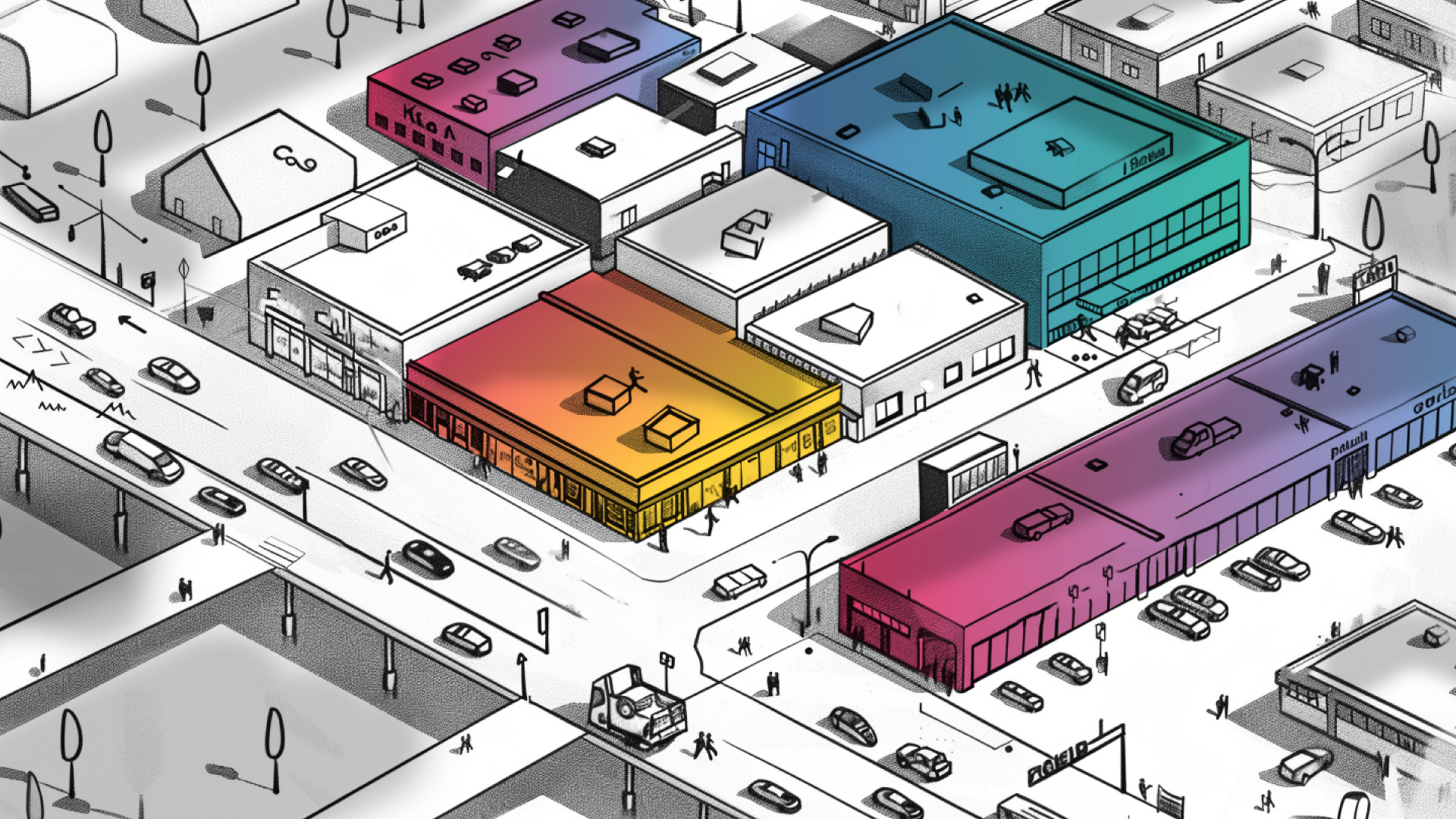

A SWOT risk analysis is a visual method for identifying positive and negative influencing factors related to a particular retail property, portfolio, market, or business venture.

Typically, you’d create four quadrants on a piece of paper. In the two left quadrants, you would identify the internal factors – the strengths and weaknesses. Internal factors are the influences within your realm of control.

In the two right quadrants, you would identify the external factors – the opportunities and threats. These are factors from the outside world that impact your venture.

A SWOT analysis is a useful tool for any kind of decision-making, but particularly useful when dealing with multi-faceted problems, where there may be many different influencing factors.

CRE professionals can use this planning tool to gain clarity on an issue, and to guide strategy going forward. There are several key moments when a SWOT analysis is particularly valuable in retail:

- Before acquiring new assets

- When considering the disposition of existing assets

- As part of annual strategic planning

- When market conditions shift significantly

- When entering a new market

- Launching a development project

Ultimately, a SWOT risk analysis helps CRE professionals to not only react to the current market conditions but also proactively anticipate and adapt to future trends and challenges. This forward-thinking approach can uncover opportunities for growth and risk mitigation before they become apparent to competitors, offering a strategic edge.

How Can GIS Help with a SWOT Analysis?

GIS location insights platforms, like AlphaMap, help you dig a little deeper when performing your SWOT analysis. For retail properties, GIS gives you access to a treasure trove of valuable information on both the macro and micro aspects of the retail market.

You can also identify locations with your ideal customer base, high foot traffic, or proximity to complementary businesses.

GIS data can reveal these competitive advantages, allowing CRE brokers and investors to leverage these strengths in strategic planning. We’ll discuss the uses of GIS in more detail in the next section.

How to Perform a SWOT Risk Analysis in 6 Steps

Step 1: Define the Objective

A SWOT risk analysis will be more effective if you define a clear objective. For our analysis, we’ll use a fictional existing retail shopping mall as our base example.

The objective for the SWOT analysis will be to address the limited parking availability that has been affecting the business of the mall, thereby improving foot traffic, tenant satisfaction, and overall mall attractiveness.

Step 2: Identify Strengths

Strengths focuses on ‘internal’ influencing factors which are within the property’s local area. Some ways you might use GIS to identify the mall’s strengths include:

- Studying property records and zoning controls which might indicate potential for development or expansion on the existing site.

- Identifying key location advantages around the shopping mall. Perhaps it’s located close to a public transport hub and this connection can be reinforced.

- Analyzing existing foot traffic trends which provides insight into the demographic profile of the customers going through the doors. Are these people with cars or are they walking there?

- Examining car traffic on and around the site.

- Reviewing the existing tenant mix using AlphaMap’s TenantFinder™ feature to see the demographic profiles of people visiting those stores.

Strengths should also include business aspects related to the mall such as the design of the property, and the property’s operations and management. Perhaps there is a large communal outside area which could be reduced to add parking.

Maybe a parking basement could be built underneath one of the levels. How efficient is the property’s cost management and operations and how might they cope with the extra responsibility of managing the parking? What is the tenant turnover and why?

Keep asking questions until you can’t think of anymore.

Step 3: Uncover Weaknesses

Weaknesses also focus on ‘internal’ influencing factors. Similarly to the processes for identifying the strengths using GIS, you may uncover some weaknesses related to the points discussed:

- The property records might show strict zoning controls which don’t allow for a new parking lot to be built on site.

- The property is in a flood zone so a basement can’t be dug into the ground.

- Car traffic reports might show intense traffic congestion at certain times of day.

- Perhaps the tenant turnover has been quite high because their customers aren’t easily able to access the site by car which has led to a higher vacancy rate.

- The center is right next to a school.

- The public transport links are weak.

Step 4: Discover Opportunities

Next, you’ll move on to analyze ‘external’ strengths which we will call opportunities. These are the macro advantages presented by the shopping mall’s location, and the greater retail context.

GIS uncovers several opportunities:

- Using trade area analysis techniques to study the greater area surrounding the malls, it’s discovered that the demographics in the area are a perfect fit for the shopping mall.

- The anchor tenant in the mall proves to be one of the main reasons people visit, and several other small shops are seen to get the most foot traffic.

- Demographics of some of the more affluent suburbs further away from the mall indicate that these people are willing to travel if there is somewhere safe to park their cars.

- There are bus routes nearby which could be linked to.

- There is an empty parcel of land next door with rights to build, the owner could consider purchasing.

- The area seems to be densifying, indicating an increasing demand for shopping malls.

- There is a new residential development half a mile away which will increase traffic by foot.

Step 5: Analyze Threats

Lastly, you’ll study the negative external influencing factors, called threats. These tend to be linked to the greater macro-economic environment of the city, state, and country, as well as current trends in the retail sector. Some examples of threats might include:

- In recent years some of the tenants cancelled their leases in the shopping mall and went online only.

- Regulations around parking in urban areas are changing, and fewer bays are required by law to be built.

- Economic downturns cause challenges for everyone, particularly those spending large amounts of money on new ventures.

- A new shopping center not too far away seems to be drawing tenants away.

Step 6: Turn Your Findings into Actionable Strategy

Now that you have a list under each heading, it’s important to decide which factors are critical and which are less so.

Translate the SWOT analysis findings into strategies which address the objective outlined at the start.

With a strategy developed, the next crucial step involves presenting this plan to stakeholders, utilizing GIS-generated visuals and projections to clearly articulate the proposed path forward.

The aim is to secure buy-in by demonstrating the data-driven rationale behind the strategy, emphasizing the expected outcomes and potential ROI.

Break down the strategy into an actionable roadmap with timelines, responsible parties, and key performance indicators (KPIs) clearly defined. This roadmap serves as the blueprint for turning the strategic vision into reality, guiding the CRE team through the execution phase with clarity and purpose.

Recognizing that the retail CRE market is ever evolving, an integral part of this step involves the commitment to regularly review strategy performance, using GIS analytics to monitor progress and make necessary adjustments.

This iterative process ensures that the strategy remains relevant and effective, driving towards the ultimate goal of maximizing retail property value and success.

Strategy Example

In our shopping mall example, the SWOT analysis revealed that the mall’s strengths are its prime location near a public transport hub and high foot traffic potential. Weaknesses were identified in the current inadequate parking facilities.

Opportunities emerged from the proximity to affluent suburbs whose residents are willing to travel if parking is accessible. Threats included the possibility of increased traffic congestion and local zoning limitations.

GIS analysis showed an adjacent parcel of land suitable for parking development, easing potential congestion concerns. It also supported demographic data indicating shopping mall visitors are highly likely to come from car-dependent households.

Possible strategies could include:

- Parking lot expansion: Decision to acquire the adjacent parcel of land for parking development, targeting an increase in parking spots by 50%. This moves to directly counter the identified weakness and capitalize on the identified opportunity.

- Traffic flow optimization: Implement a traffic flow analysis using GIS to redesign entry and exit points, ensuring seamless movement to and from the new parking area, reducing potential congestion and enhancing shopper experience.

Final Thoughts on the Importance of SWOT Risk Analysis in CRE

A SWOT analysis, powered by the precision and depth of GIS, provides CRE professionals with an unparalleled toolset for navigating the complexities of the retail real estate sector. By transforming raw data into strategic insights, CRE brokers can stay agile in a market defined by rapid changes and high competition.

Start integrating GIS into your SWOT evaluations and witness how it revolutionizes your approach to investment and strategy development. Book a demo with the AlphaMap team today.